By Iris An

Sitting in the 21st Avenue coffee shop with my pumpkin spice latte, I opened my next week’s reading assignment for BUSA 3710 and found myself staring at six articles about Starbucks—in a Starbucks (the irony of this weekend study mode was not lost to me).

As its name indicates, BUSA 3710: Corporate Valuation is a course introducing the methods of intrinsic, relative, and contingent valuation. Like Aswath Damodaran, the “dean of valuation,” once said, “A craft is a skill that you learn by doing. The more you do, the better you get.” Valuation is a craft that requires experience with a vast array of companies and their constantly fluctuating values. One way to expand one’s knowledge on a variety of businesses is to read about them. This is when the class reading becomes helpful. Prof. Willis Hulings likes to select news articles about a certain company or industry, from major finance to business journals, with a scope that extends from 2018 to the day before class.

So, what’s the story of Starbucks?

Our reading followed the changing leadership of Starbucks from Kevin Johnson, a former Microsoft executive and longtime Starbucks board member who curbed ambitious plans for a related brand of upscale coffee shops and tried to bring more financial discipline to the business; to Howard Schultz, founder and three-time CEO who has the ambitious plan to open 2000 new stores in the US and pledged to return $20 billion to shareholders across 2023 to 2025 fiscal years; and finally, to the future CEO Laxman Narasimhan who is currently the CEO of the UK-based Reckitt Benckiser Group.

(If you are interested about the visions and actions of the Starbucks’ CEOs , our complete Starbucks reading list is at the end of this article. Feel free to go and have a look.)

What I find interesting, however, is Schultz’s wild ambition for China: 9,000 stores by 2025. This sounds overly impressive, given that it only has 5,358 stores as of 2022. Is Schultz’s vision even possible?

If so, how far is Starbucks from its 2025 goal?

Starbucks on the 21st. Avenue, photo taken by author

Starbucks struggles in China as other coffee and milk-tea brands pose threat

In an interview with CNBC, Schultz again reiterated the importance he attaches to the Chinese market, saying that “China will overtake the U.S. as Starbucks’ biggest market by 2025.” However, in order to realize this vision, Schultz will need to reverse its current performance in China and to counter its less expensive milk tea competitors.

As of the end of April 2022, China remains the second largest market for Starbucks. But despite its formidable size, Starbucks remains mired in a steady decline in sales.

Adversely, since entering fiscal 2022, Starbucks’ China sales seem not so appealing: same-store sales in China fell 14% in the first quarter and average unit sales declined 9%; by the second quarter, same-store sales in China declined 23% due to a 20% decline in same-store transactions and a 4% decline in average customer unit price.

In the third quarter, Starbucks’s revenue in China plunged 40% to $540 million, and same-store sales in China fell 44%, driven by a 43% drop in passenger flow, which Schultz explained was primarily attributable to COVID-19-related restrictions in China and the impact of foreign currency translation from China.

Facing sales decline from harsh lockdown policies, Starbucks is not the only one that sets its goal on expansion.

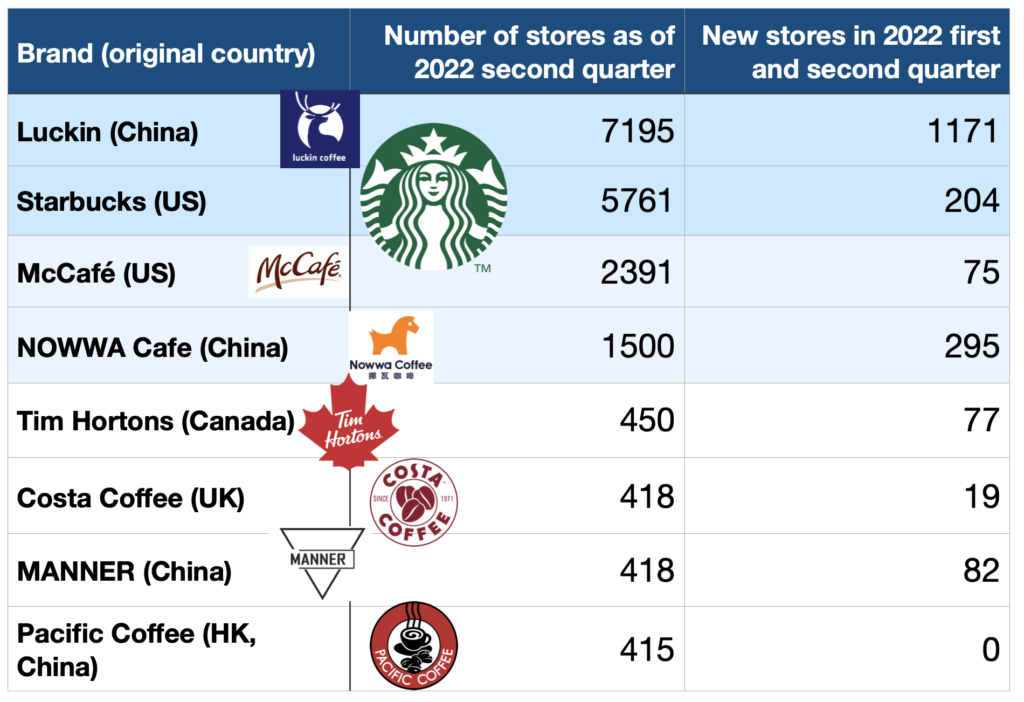

In the first half of 2022, China’s 17 domestic coffee chains opened a total of about 3,075 new stores. On average, more than 450 new stores opened each month, which made a total coffee store number of nearly 19,000, among which 5,358 belonged to Starbucks, 7195 belonged to China’s largest competitor Luckin, and 450 were of the Canadian multinational fast food restaurant chain Tim Hortons.

Number of stores and new store openings of 8 major coffee brands operating in China (Source: 36Kr, WorldAltas, nowwa.com)

Tim Hortons China prices its products slightly higher than in Canada but slightly lower than Starbucks, focusing on the mid-range of 15-30 yuan ($2-4), and builds its own kitchen in store to provide fresh food products. More localized than Starbucks, Tims China has responded to the Chinese eating behavior by adding warm food and providing less sweet desserts. As of July this year, the number of Tims China coffee stores reached 450, which means since its entry into China in 2019 Tims China has been expanding at a speed of almost one store every 3 days.

Like Tim Hortons, Nowwa Coffee also opened its first store in 2019, and has rapidly expanded to more than 1,500 stores with its “small store quick pickup” model. Nowwa is known for the speed of new product launch, having 11 new products in the first half of 2022.

Starbucks, who once dominated the domestic coffee circuit, was surpassed by Luckin in the number of stores in China by the end of 2021 (as of 2021, the number of Starbucks stores in China is 5557, Luckin 6024), and is also facing local coffee brands such as Manner, Nowwa, and milk tea brands such as Nayuki, HeyTea, Mixue IceCream&Tea, and even cross-border rivals such as Tims Hortons competing for market share.

Number of stores and new store openings of 8 major milk tea brands in China (Source: 一览商业, Tech, individual brand websites)

Under the gradually encroaching Chinese market, Starbucks, unable to sit still, began to accelerate the pace of store openings, expanding dramatically from 600 in 2019 to 5,557 in 2021, and plans to reach 6,000 in 2022.

But in terms of the actual situation in 2022, the challenge to achieve the 6,000-store target is huge. With the current 5,761 stores, Starbucks will need to open 239 new stores in the next five months, or an average of nearly 48 new stores per month. In the second quarter, Starbucks added only 97 new stores in China, and 107 in the third quarter, which is still less than 40 stores per month.

The Disenchantment of Shanghai, the Capital of Coffee in Asia

After 20 years of rapid growth, Shanghai has become the number one coffee consuming city in China and the strongest coffee consumer in Asia. This has made Shanghai the first choice for coffee brands to start-up or to expand. Unsurprisingly, Shanghai also happens to be the most important city for Starbucks in China, holding nearly 1000 out of 5761 stores.

The Shanghai COVID-19 lockdown—which lasted from February 28th to August 7th in 2022–caused the economy to shrink 14%.

The impact of the pandemic on Starbucks is not just a drop in store traffic. Since 2020, Starbucks has slowed down its expansion in China, undermining its goal of 6,000 stores by 2022. The slowing of store openings and the “optimization” of some underperforming stores has left Starbucks with a gap of more than 300 stores short of its goal. In the second quarter, Starbucks opened 97 new stores. At this rate, it is doubtful that Starbucks will complete 6,000 stores in 2022.

A more profound impact is that the continued pandemic restrictions and popularity of remote-working may change the habits of coffee consumers. Sales of bottled coffee, coffee capsules, and fine instant coffee have increased significantly on e-commerce platforms, while sales of equipment, such as coffee machines, have experienced continued growth since 2021. One possible outcome is that after the return to normalcy in cities like Shanghai, there will be a wave of retaliatory consumption by consumers. At the same time, however, “coffee at home” may also become the new routine, competing with offline stores.

Opened in 2017 in Shanghai, the 30,000 square feet Starbucks Reserve Roastery is the largest Starbucks store in the world, but was closed for more than 2 months due to the Shanghai COVID-19 breakout.

Future Prospects

Given CEO Howard Schultz’s radical expansion plan, Starbucks is clearly not retreating from the China market but instead rapidly gaining strength in the online coffee market with its large supply chain and brand value. Q2 fiscal results showed that Starbucks’ sales through digital channels reached 43% in the second quarter, setting a new record. After its new alliance, Starbucks also established its channels in China’s two largest online food ordering platforms: Meituan and Ele.Me since January.

To improve employee retention rate, Starbucks China has also begun to increase employee wages and benefits. Last November, Starbucks China announced on its website that all full-time retail partners (employees) in Starbucks China will be entitled to “14 day salary” for the first time starting in October 2021.

During the earnings call, Schultz announced that he would invest $1 billion in fiscal 2022 to make additional investments in partners and stores, such as pay raises, modern training and collaboration, and store innovation.

Right now, Starbucks is facing a further decline in sales in core Chinese cities as Beijing, Hainan, and Chengdu tighten controls on pandemic policies. It remains questionable whether the fourth quarter sales can reverse the unsatisfying performance of the first three quarters. If China does not return to its high growth rate of the pre-pandemic era, will the US market be able to support Starbucks’ full-year growth momentum?

Further, when the pandemic is over and can no longer be used as an excuse, what are some other new strategies that can keep Starbucks’ advantage against numerous domestic competitors, enabling them to squeeze in 6000 stores in an “overcrowded” market?

Full reading list from BUSA 3710 class on Starbucks:

- Starbucks CEO Kevin Johnson Reins In Predecessor’s Ambitions_ ‘I’m Not Howard’

- How Starbucks Changed Under Departing CEO Kevin Johnson

- WSJ: The Economics of Starbucks

- Starbucks Spills the Beans on Its Future

- With Starbucks CEO succession plan in place, Howard Schultz plots his priorities

Note: All Vanderbilt University students, faculty and staff can create accounts to access the Wall Street Journal and other publications.