During the 1970s, the United States suffered from double-digit inflation, rising unemployment, and bleak economic prospects. Declining domestic industry and increasing global competition sowed the seeds of doubt in American minds and the OPEC oil embargo shook the economy to its core. The crisis culminated in a period of stagflation, a stagnant economy ill with both high unemployment and inflation. Monetary policy and the Federal Reserve had failed in both of their mandates: full employment and price stability. The global monetary order created by the Bretton-Woods agreement collapsed and the US found itself forced to detach the dollar from the gold standard. However, the world today is not racked by hyperinflation. The Fed eventually managed to tame the price instability of the so-called “Great Inflation,” and the period of calm that followed came to be known as the “Great Moderation.”

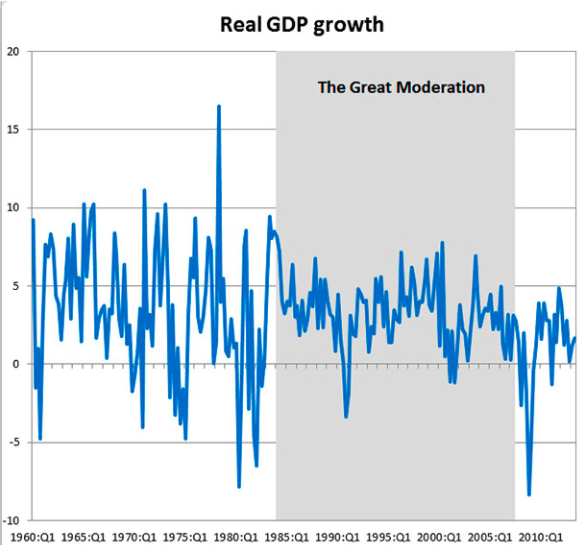

The Great Moderation refers to a period of relative macroeconomic stability in the United States between 1982 and 2007. Characterized by low, steady interest rates, the Great Moderation contained the longest sustained period of economic growth in US history. While some consider the period to have ended with the Great Recession, it is still unclear whether the crisis of 2008 ended or merely interrupted the Great Moderation. There may be similar debate about the economic crisis induced by the COVID-19 pandemic in the future. Regardless, the Fed will continue to use the monetary policy tools created in the face of the Great Inflation that have marked its activity during the Great Moderation.

The main forces behind the Great Moderation include the changing structure of the US economy, good luck, and good monetary policy, combined with a framework of basic price stability. Between the 1970s and 1980s, the US shifted from a large industrial sector to a largely service-based economy. Service industries are much less volatile than manufacturing, partly due to the lesser need to anticipate demand and stockpile inventory. Manufacturers also began adopting just-in-time manufacturing in which products are produced more quickly so that manufacturers are faster to respond to changes in the economy. Firm flexibility also benefited from deregulation, advances in information technology, and more open global trade. The increased flexibility of firms allowed them to respond better to and be more resilient against economic shocks.

However, this flexibility did not help the economy during the Great Recession. Some economists believe the economy simply benefited from a long period of relatively small shocks. These economists explain the Great Moderation simply as a story of good luck. They cite evidence showing that shocks produced smaller economic effects during the Great Moderation. However, these effects are not direct measurements of the size of shocks. Nobel laureate Christopher Sims draws an analogy between shocks and kitchen fires. When a fire breaks out, measuring the impact on the economy can be thought of as measuring the change in the temperature of the room. In this metaphor, fire extinguishers represent monetary policy. Even large fires will have only small impacts on the overall temperature of the room if they are extinguished quickly. Thus while luck certainly played a role in the Great Moderation, successful monetary policy must not be overlooked.

A focus on price stability formed the basis of monetary policy after the Great Inflation. Reacting to double-digit inflation, the Fed prioritized controlling prices over stimulating full employment. It also committed to acting more systematically whenever inflation or output rose above desired levels. The Fed also began following the Taylor Rule which dictates that the Federal Funds Rate should be raised by more than the observed increase in inflation so that real interest rates actually rise. Before the Great Moderation, the Fed often failed to react to high inflation for too long, and when it did, it did not raise the Federal Funds rate by enough and loosened its policy stance too early. Therefore inflation remained erratic until the Fed began to act more systematically to keep it stable. The Fed also became much more transparent about its actions. It began to provide a target inflation level to help anchor expectations, and in 1994, the Federal Open Market Committee, the monetary policy arm of the Fed, began to release short statements any time it took significant action. The FOMC now releases a substantial report after every meeting detailing its actions and expectations for the future.

The Fed adopted these measures after the Great Inflation shattered pre-existing ideas of how monetary policy worked. Between the Second World War and the 1970s, unemployment and inflation had been strongly negatively correlated, meaning that the Fed could exploit the tradeoff between the two to reduce unemployment. However, short-term tradeoffs proved unsustainable. The so-called Phillips relationship collapsed as the Great Inflation gripped the economy and unemployment and inflation increased in unison. Modern monetary policy does not attempt to exploit tradeoffs for short-term gain, rather focusing on basic price stability using measures that are sustainable in the long term.

The long-term future of the Great Moderation is in doubt as some economists contend it ended in 2007 while others say that the Great Recession merely represents an interruption. Volatility did increase in the years immediately following the Great Recession though it more recently returned to lower levels. The shock of the COVID-19 Pandemic has created a crisis that certainly shatters the trend of the Great Moderation but it comes courtesy of a shock greater than any in modern times. Only time will tell if the low volatility of the Great Moderation will continue in the future.

A return to Great-Moderation levels of economic stability will certainly be welcome after the hardship of the current economic crisis. The primary goal of monetary policy and the existence of central banks is to allow for smoother economic growth with fewer and less severe recessions. High levels of volatility cause increased poverty, unemployment, and inequality, creating unsustainable debt levels and financial uncertainty. The UN labels macroeconomic stability as a “prerequisite for sustained and inclusive development.” Once economic stability is achieved, governments are relieved of the constant need to address poverty and unemployment, freeing up resources to deal with other social issues. Once the issue of survival is dealt with nations can turn toward forging a better future.

Key to maintaining economic stability is controlling inflation. Expectations of future prices and inflation factor into the business decisions of firms of all sizes as well as consumers. By keeping inflation stable, central banks can remove a confusing factor from people’s economic calculus. This helps consumers and businesses make better decisions, leading to a more efficient allocation of resources, and thus greater economic growth and wellbeing. Low and stable inflation also benefits borrowers by reducing risk premia required by lenders. If inflation is high or unpredictable, banks and other lenders will charge more for loans because they incur greater risks by lending money. By reducing these charges, central banks can encourage investment and create the promise of greater future growth. Unexpected inflation causes arbitrary redistributions of wealth as well as financial market instability and financial uncertainty for the population. Avoiding these consequences is another benefit of price stability among many others.

The Great Inflation demonstrated what can happen when bad luck and bad monetary policy combine. But through the Great Moderation, comes a glimmer of hope. People around the world depend on economic stability to help them rise in society and achieve their dreams. While the Fed and other central banks cannot control everything in the economy, they certainly have a responsibility to attempt to keep the business cycle as smooth as possible. Irresponsible monetary policy led to the Great Inflation but more sustainable policies allowed the longest period of economic growth in US history. The difference between a crushing recession and an environment that allows economic development is why it is important to understand macroeconomics and why monetary policy matters to society.