Negative Interest Rates: A Novel Solution or a Novelty Item?

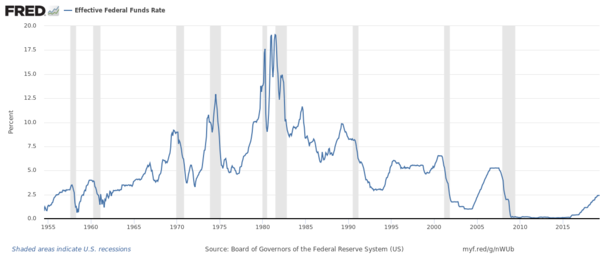

In the wake of the economic downturn caused by the COVID-19 pandemic, some in the United States, including president Donald Trump, have called on the Federal Reserve to push interest rates below zero. Negative interest rates would be unprecedented in the US but they have become established monetary policy in Europe and Japan. Such rates represent a logical extension of expansionary monetary policy while also breaking key economic laws. This counterintuitive policy raises more questions than it appears to answer. How do negative interest rates work? could we really be paid to borrow money? and most importantly, can negative interest…