For years, many have talked about the inevitability of a recession. Throughout my time at Vanderbilt, discussions regarding how it will be difficult to find a job when we graduate always came up. In this unprecedented time, it seems as if the global economy is on the verge of collapsing. From sports’ leagues shutting down for an undetermined amount of time to the demand for gasoline falling to the Dow Jones industrial average tumbling, nothing seems to be going right economically. There are not many people, or companies, who are profiting right now. Of course, money should be the least of anyone’s concerns right now. However, a burning question permeates my mind: will we be able to recover when this is all over?

At the moment, the United States is technically not going through a recession. The unemployment rate is low, and GDP per capita has been increasing. But we will see the effects on these factors eventually. In fact, the stock market has already reached new lows. Although the S&P 500 increased on March 19th after previously falling by “more than 3 percent,” but maintaining the earnings has been a struggle. On March 18th, oil prices fell by more than 20 percent. At some point in time, the domino effect on the United States’ GDP per capita and unemployment rate will be seen.

In fact, JPMorgan projects that GDP will fall at “an annualized rate of 14% in the second quarter,” and the unemployment rate will nearly double what it currently is by the middle of the year. If we look at projections on a global level, the numbers are much worse.

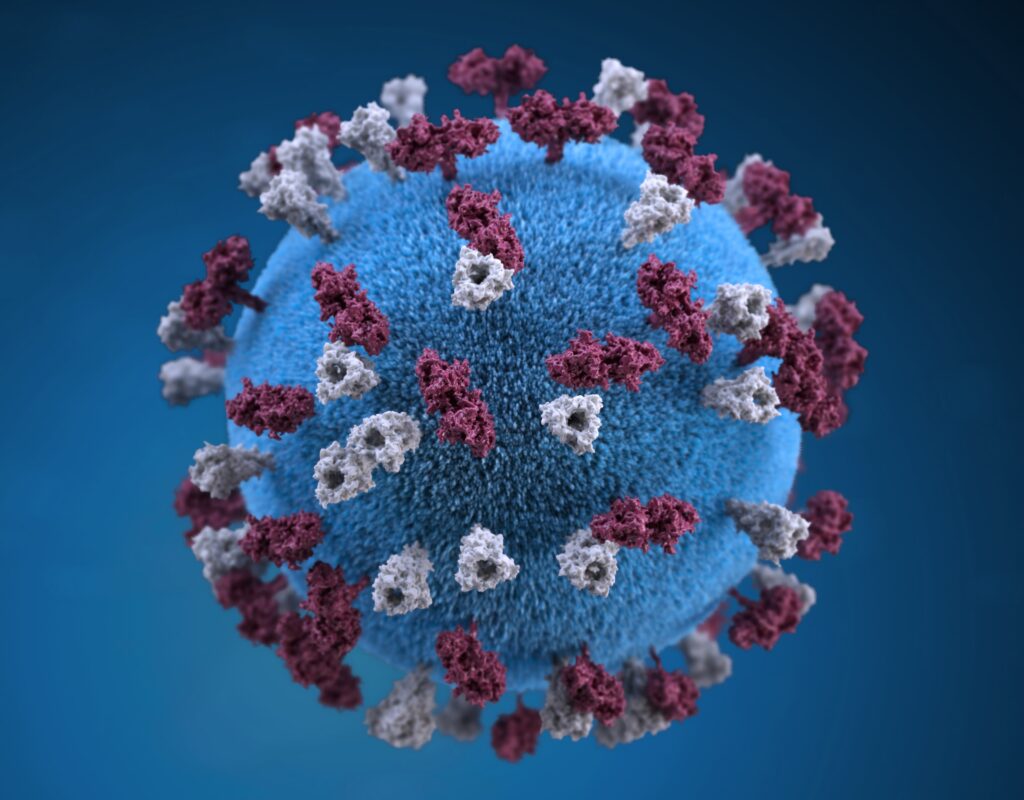

A recession is inevitable, but the coronavirus has singlehandedly pushed the economy into a state we would never have expected.