In the wake of the economic downturn caused by the COVID-19 pandemic, some in the United States, including president Donald Trump, have called on the Federal Reserve to push interest rates below zero. Negative interest rates would be unprecedented in the US but they have become established monetary policy in Europe and Japan. Such rates represent a logical extension of expansionary monetary policy while also breaking key economic laws. This counterintuitive policy raises more questions than it appears to answer. How do negative interest rates work? could we really be paid to borrow money? and most importantly, can negative interest rates pull the world economy out of recession?

Historically, negative interest rates have been used as an expansionary monetary policy to ward off or recover from recessions. In 1971, following president Richard Nixon’s decision to move the US dollar off of the gold standard, world currencies began fluctuating in value relative to each other and the dollar began to decline. Through the agitated currency market one nation appeared to be a safe haven. The neutral ground of Switzerland presented a safe harbor for international investors to park money outside the volatility of the rest of the world currency market. However, the influx of investment drove up the value of the Swiss franc, threatening Switzerland’s export-heavy economy. In response, the Swiss National Bank first announced reserve requirements, and then a 2% penalty per quarter on those buying francs. The 1973 oil shock brought about another round of negative rates as the Swiss penalized foreign deposits at 12% and eventually as high as 41%. Only in 1982, when the US had largely tamed its own inflation problems could the Swiss government abandon its extreme negative rates.

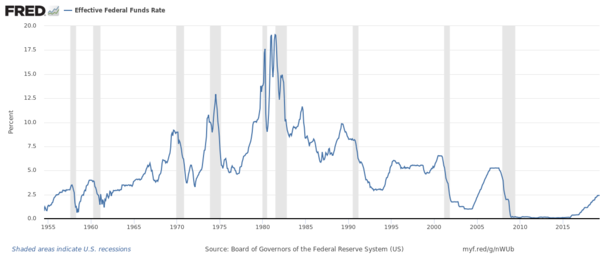

Following the 2008 financial crisis, negative rates returned to Switzerland and spread to the European Central Bank (ECB), Japan, and other nations. What was meant to be a temporary solution has become an established policy as the ECB has kept its rates negative since 2014 and lowered its rate to -0.5% in September 2019, the same month in which the Federal Reserve lowered its own rates in response to fears about future weakness in the world economy.

Now that those fears have been realized, it is important to understand how negative interest rates work and how they can apply to the current situation.

The Federal Reserve regularly lowers the federal funds rate as a way to stimulate the US economy. Lower interest rates make it cheaper to borrow money to spend or invest, so a reduction of interest rates is an expansionary monetary policy meant to inject money into the economy. Lower interest rates reward those who borrow with cheap money and punish those who save by preventing them from generating interest on savings. Negative interest rates go further by penalizing those who hoard money. By lowering the federal funds rate below zero, the Fed would try to force banks to lend money instead of maintaining deposits at the Federal Reserve. Additionally, riskier and less profitable loans would become economically viable because keeping money at the Federal Reserve would cost banks more.

Importantly, a negative federal funds rate would not automatically apply negative rates to individual savings accounts or loans, but those rates generally follow the federal funds rate as banks become more or less willing to lend money. Therefore, a negative federal funds rate would not automatically mean banks would pay you to borrow money or charge you to deposit.

Before negative rates became a reality across Europe, many economists assumed rates could not fall below zero because people and institutions would just hold onto cash instead of depositing it in banks or other investments with negative yields such as bonds. However, holding hard currency comes with costs of its own. Keeping money under the mattress is not a risk-free investment. Cash can be stolen or destroyed in a house fire and is difficult to use for large or remote transactions (especially during a pandemic when more transactions must be carried out online). The costs of holding currency in large quantities mean that zero is not the lower bound for interest rates. Even a money-losing investment can be more economically sound than hiding money under the mattress in some circumstances. In fact, European banks, though initially reticent to extend negative rates to customers have begun to institute fees for maintaining deposits though they have not begun paying customers to borrow. The negative rate on savings has not created a run on banks as consumers still prefer storage charges to keeping large sums of cash on hand.

The passing of costs onto consumers has led many to liken negative interest rates to a tax. The government is essentially taxing central bank deposits so the burden of this tax will be shared by both the bank and its customers. Furthermore, the ECB has established a tiering system that exempts portions of banks’ deposits in order to spare them some of the negative effects of negative interest rates. Negative rates, like any tax, may create a burden on banks that reduces their willingness to lend. This burden is highest during periods of quantitative easing. When the Federal Reserve buys bonds as a method of injecting capital into the economy, it creates new central bank deposits. If the federal funds rate is negative, those deposits will then be taxed. Transfer payments such as the recent CARES Act would also be subject to fees levied by banks on personal savings accounts. Therefore negative interest rates may reduce the effectiveness of other expansionary monetary and fiscal policies.

On top of the possible negative effects, the positive effects of negative interest rates are unclear. If the goal of such rates is to increase the availability of loans, they may not succeed. Central banks are only likely to drive rates below zero when rates have already been near zero for some time. In this situation, banks have likely lent to almost everyone who wants a loan and is judged to be creditworthy. Any further decrease in interest rates will create diminishing returns in the volume of additional loans that banks are willing to make. Finally, like many expansionary policies, the increased money supply created by negative interest rates will have a reduced impact on the pandemic-induced recession because of the low velocity of money. Regardless of how much money is available, if consumers are not able to spend it, the policy will not have the intended effect.

In conclusion, while negative interest rates are not likely to rescue the economy from COVID-19, they are a legitimate policy in the arsenal of the Federal Reserve. The costs of holding currency mean that zero is not a lower bound for interest rates and a negative rate will not stop people from keeping money in banks nor will it stop banks from lending. While the Fed may not use negative interest rates to combat the current recession, they remain a possibility for future recessions.